The reasons why evaluation of confusion matrix such as Accuracy cannot be used in binary classification

The characteristic such as Accuracy are often used to evaluate the accuracy of the machine learning, but this is not the case in the financial sector. Before explaining the reasons why it is not used in the financial sector, let me explain about the evaluation index including confusion matrix. For those who are familiar with the terms, please skip to “Problems” and “Conclusion”. Confusion matrix Confusion matrix is a summary of the prediction and its results in a matrix format. In the case of binary classification in the machine learning, the predicted probability and its predicted clarification will be the output. For example, the ratio of becoming delinquent and not […]

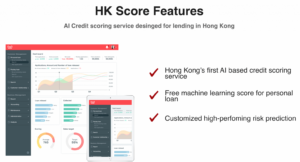

Use case of HK Score ‘Customized’ plan

The Hong Kong first AI credit scoring service, “HK Score”, has been launched by WKWK recently and we already have a contracted client that is about to start deploying the service. Let us share some details about the service that we are currently providing using the case of this client as an example this time. The client has several years of experiences as a leader of personal loan business and they have a cumulative total of approximately a hundred thousand of customers. They have simple score cards as an internal underwriting process. However, it has not been updated since the implementation several years ago and now it is being used […]

Unleash Gen Z’s credit potentials

Most of lenders still believe in a myth that Gen Z consumers are in the subprime or generally higher risk credit tiers due to a lack of positive repayment histories, but is this really true? According to TransUnion’s report, Gen Z consumers are more likely to be prime or prime plus, and nearly a quarter (24%) have credit scores in the super prime risk segment in Hong Kong market. Why not you as lenders to promote your loan products to Gen Z? WKWK will set up a structure that allows you to leverage machine learning as soon as you collect enough data to create your own risk models. Unleash Gen Z’s credit potentials […]

Website just updated!

Website has been updated in conjunction with the launch of our new service “HK Score”. A new page for HK Score has been added together with the language in traditional Chinese as well. HK Score is the Hong Kong first AI credit scoring service developed for lending business in Hong Kong. With WKWK original machine learning technologies, risk prediction model is even more simple, the underwriting and credit decisions becomes more precise and speedy. We can transform lending with the power of machine learning.In order for us to contribute to a healthy growth of lending business in Hong Kong, the plans and the price setting have been reviewed so that […]

HK Score debut!

“HK Score”, the Hong Kong first AI credit scoring service, has debut. HK Score which utilizes WKWK original machine learning technologies will be provided as a subscription service for those in lending business in Hong Kong.WKWK aims to contribute to a healthy growth in Hong Kong lending business through HK Score. Based on the AI credit score provided by HK Score, the visualization of risk prediction and quantitative analysis become possible. This will lead to minimization of bad loan and maximization of portfolio return. In addition, as the credit decisions will be made based on the machine learning technologies, unnecessary biases will be excluded from its decisions, which will result […]

Evaluation of Prediction Models – Logarithmic Loss –

Introduction We would like to talk about logarithmic loss, or simply log loss this time. Similarly to Gini coefficient, log loss is one of the popular indexes used for determination in model development using machine learning. Though the calculation method is rather complicated compared to Gini coefficient, it would be sufficient if you could understand the meaning of the values as the actual calculation will be done by the machine. Let us begin with an explanation about what log loss is. What is “Log Loss”? Log loss is to quantify a gap between the predicted probability and its result using the cross entropy. The cross entropy is defined based on […]

WKWK’s new solution ‘OCR’

WKWK has introduced a new business solution with OCR. Let us share a story about our client who requested our service with OCR technologies as an example to help you understand what our new solution can do for you.Client’s situation:The client was seeking a way to improve their profit structure by minimizing the nonperforming loan and reducing bad debt. They have shared the past transaction data to WKWK so that a customized credit risk prediction model could be developed. A part of data was available as paper-based only and not saved in their loan management software. However, their underwriting process were made based on comprehensive analysis which included this paper-based […]

Launching a blog!

WKWK blog is coming! Our CTO and the machine learning engineering team will be sharing information such as basic knowledge in terms of machine learning to you. In the series one, the basic knowledge that is required in order to understand PoC (Proof of Concept) will be mainly introduced. There will be special terminologies often used in the contents of PoC when we create a risk prediction model and provide PoC to you. In order to utilize the machine learning model, it is essential to understand the contents of PoC, thus we would like you to acquire those necessary languages. We aim to share information that will be valuable for […]

HK FinTech Week

WKWK management members visited HK FinTech Week at AsiaWorld-Expo in the week of November 4th. Many speakers from the regulators such as HKMA were participating in the event this year. It was a good opportunity to see how each country was eager to actively impellent Fintech in their environment. We as WKWK were able to meet some technology companies doing AI, machine learning, and lending business. It was a great chance to exchange opinions and do brainstorming on potential partnerships that could be beneficial on both sides by being mutually complementary on functions and resources.WKWK provides an AI credit scoring service which specializes on lending business growth. We found that […]

Predictive model evaluation -Gini Coefficient-

introduction It is said that the model which is made by AI often becomes black boxes, but nowadays they are changing to a more descriptive form. WKWK also has a white box model that users can understand.So how a risk model should be evaluated by when machine learning? In the case of credit scores, one of the representative indicators is the Gini Coefficient. In general consumer finance, the value varies greatly depending on the business model, such as 30% to 80%. It becomes one of the substantial reasons to say it is a credible model when the values are higher.Let us explain what the Gini coefficient is. What is Gini […]