News&Updates

A credit scoring model for non-TransUnion lenders has been just updated and now available with HK Score

We are pleased to announce the update of credit scoring model for non-TransUnion members. The non-TransUnion members are money lenders who are independent from TransUnion’s credit history data. In general, they are targeting subprime borrowers and dealing with higher credit risks in the consumer credit market without accessing TransUnion’s data. However, most of them don’t have risk modelling and credit scoring so that they still rely on human decisions with inconsistency which tend to include unnecessarily biases and they cannot correctly respond to environment changes at time like now. This is where CREDI AI can improve. The model can help those lenders to start measuring potential risks by using credit […]

New company name announcement “CREDI AI”

We are proud to announce that our company name will change to CREDI AI Limited, effective 20th August, 2020. The name change is a result of rebranding effort designed to mirror the growth and focus of our company. This name change will allow us to present our company’s directions and solutions to customers, which are truly dedicated to build AI/ML based risk models for better credit decisions.Our commitment to our customers and partners remains as our highest priority. By rebranding ourselves as CREDI AI and becoming a complete AI-driven credit technology company, we believe that we can provide solutions to our customers with more accurate prediction models. Along with the new name, the rebranding will be adapted […]

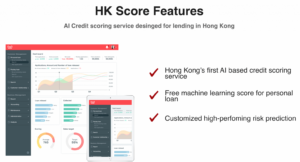

HK Score has been just upgraded and now with new monitoring features

We are very pleased to announce the upgrade of HK Score. The majority of the enhancements in the new version of HK Score was focused on adding monitoring functionalities to the users and making the navigation of the software more intuitive. These enhancements allow our users to monitor model’s accuracy more effortlessly and find potential risks quickly. The software can navigate our users to react speedily in order for them to make more precise or appropriate loan decisions under the virus-driven recession. The following list shows our roadmap of the development of HK Score. There are upcoming features that are currently under development or in our plan to be introduced […]

Lenders are required to consider consumer financial hardships

The seasonal adjusted unemployment rate in Hong Kong increased to 5.9% in the three months to May 2020 from 5.2% in the previous period, which was the highest jobless rate since the three months to April 2005, amid the virus-driven downturn. Hong Kong unemployment hits 15-year high with 5.9% out of work TransUnion has also released their Consumer Financial Hardship Survey by a webinar, which is now available on-demand for you to view. You can refer the following link. Here’s the brief summary of the survey on the consumer financial hardship due to COVID-19: As TransUnion provides a recommendation, lenders are required to extend relief programs with term extensions or […]

Use case of HK Score ‘Customized’ plan

The Hong Kong first AI credit scoring service, “HK Score”, has been launched by WKWK recently and we already have a contracted client that is about to start deploying the service. Let us share some details about the service that we are currently providing using the case of this client as an example this time. The client has several years of experiences as a leader of personal loan business and they have a cumulative total of approximately a hundred thousand of customers. They have simple score cards as an internal underwriting process. However, it has not been updated since the implementation several years ago and now it is being used […]

Unleash Gen Z’s credit potentials

Most of lenders still believe in a myth that Gen Z consumers are in the subprime or generally higher risk credit tiers due to a lack of positive repayment histories, but is this really true? According to TransUnion’s report, Gen Z consumers are more likely to be prime or prime plus, and nearly a quarter (24%) have credit scores in the super prime risk segment in Hong Kong market. Why not you as lenders to promote your loan products to Gen Z? WKWK will set up a structure that allows you to leverage machine learning as soon as you collect enough data to create your own risk models. Unleash Gen Z’s credit potentials […]

Website just updated!

Website has been updated in conjunction with the launch of our new service “HK Score”. A new page for HK Score has been added together with the language in traditional Chinese as well. HK Score is the Hong Kong first AI credit scoring service developed for lending business in Hong Kong. With WKWK original machine learning technologies, risk prediction model is even more simple, the underwriting and credit decisions becomes more precise and speedy. We can transform lending with the power of machine learning.In order for us to contribute to a healthy growth of lending business in Hong Kong, the plans and the price setting have been reviewed so that […]

HK Score debut!

“HK Score”, the Hong Kong first AI credit scoring service, has debut. HK Score which utilizes WKWK original machine learning technologies will be provided as a subscription service for those in lending business in Hong Kong.WKWK aims to contribute to a healthy growth in Hong Kong lending business through HK Score. Based on the AI credit score provided by HK Score, the visualization of risk prediction and quantitative analysis become possible. This will lead to minimization of bad loan and maximization of portfolio return. In addition, as the credit decisions will be made based on the machine learning technologies, unnecessary biases will be excluded from its decisions, which will result […]

Evaluation of Prediction Models – Logarithmic Loss –

Introduction We would like to talk about logarithmic loss, or simply log loss this time. Similarly to Gini coefficient, log loss is one of the popular indexes used for determination in model development using machine learning. Though the calculation method is rather complicated compared to Gini coefficient, it would be sufficient if you could understand the meaning of the values as the actual calculation will be done by the machine. Let us begin with an explanation about what log loss is. What is “Log Loss”? Log loss is to quantify a gap between the predicted probability and its result using the cross entropy. The cross entropy is defined based on […]

WKWK’s new solution ‘OCR’

WKWK has introduced a new business solution with OCR. Let us share a story about our client who requested our service with OCR technologies as an example to help you understand what our new solution can do for you.Client’s situation:The client was seeking a way to improve their profit structure by minimizing the nonperforming loan and reducing bad debt. They have shared the past transaction data to WKWK so that a customized credit risk prediction model could be developed. A part of data was available as paper-based only and not saved in their loan management software. However, their underwriting process were made based on comprehensive analysis which included this paper-based […]