What comes next to consumer credit market in Q2 2020?

Delinquency rates have been increased and lenders have tightened underwriting in Q1 2020. What comes next to consumer credit market in Q2?

TransUnion has released their Q1 2020 Industry Insights Report by a webinar, which is now available on-demand for you to view anytime. You can refer the following link.

Here’s the brief summary of the report on the consumer credit market:

- Delinquency rates of most of unsecured products such as credit card, personal loan and revolving line have continued to increase since 2019.

- Under the current situation with the virus-driven recession, especially the delinquency rate of 30+ day past due have been shown a noticeable increase in Q1 2020.

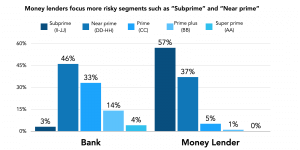

- Money lenders focus on more risky segments. For near prime or below segments, banks decreased personal loan balances by 8.1% from Q4 2019, on the other hand, money lenders increased by 4.7% and gained more market shares from banks as a result.

As TransUnion gives a heads up, money lenders who concentrate their loan portfolio within near prime or below segments should carefully monitor the downward risk amid the economic downturn.

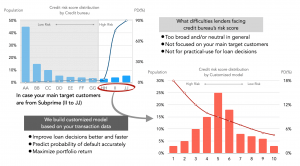

At CREDI AI, we can build a high-performing predictive model for lenders who even focus on risky segment such as subprime. While TransUnion’s CVS risk score only shows metrics such as II or JJ in case for subprime, our model technique enables lenders to visualize credit risks more clearly. It means that lenders can make better loan decisions based on the customized model which enables to predict probability of defaults accurately as shown in the below slide.

If you are considering implementing even more accurate risk model based on machine learning, or striving for more efficient underwriting process, contact us! Our experts in lending business are committed to provide solutions that will improve your lending business.

Please refer to the link below for more details:

https://www.transunion.hk/lp/IIR

TransUnion Q1 2020 Industry Insights Report | TransUnion Hong Kong

TransUnion Industry Insights Report