Use case of HK Score ‘Customized’ plan

The Hong Kong first AI credit scoring service, “HK Score”, has been launched by WKWK recently and we already have a contracted client that is about to start deploying the service. Let us share some details about the service that we are currently providing using the case of this client as an example this time.

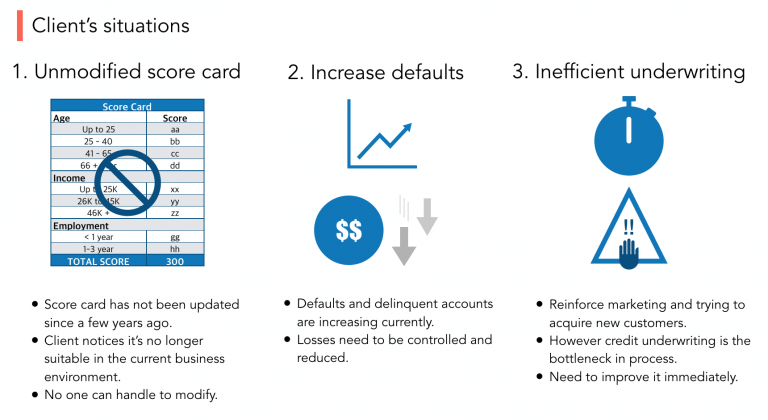

The client has several years of experiences as a leader of personal loan business and they have a cumulative total of approximately a hundred thousand of customers. They have simple score cards as an internal underwriting process. However, it has not been updated since the implementation several years ago and now it is being used only as one of references for the credit decisions. The delinquents and defaults tend to increase due to the changes in business environment, and they are currently at the stage in which such loss needs to be minimized. The client has been making the effort to reinforce the online marketing and further develop storefront business, and in order for them to further increase the number of customers and reduce the delinquents at the same time, they consulted WKWK about implementing the HK Score to their system.

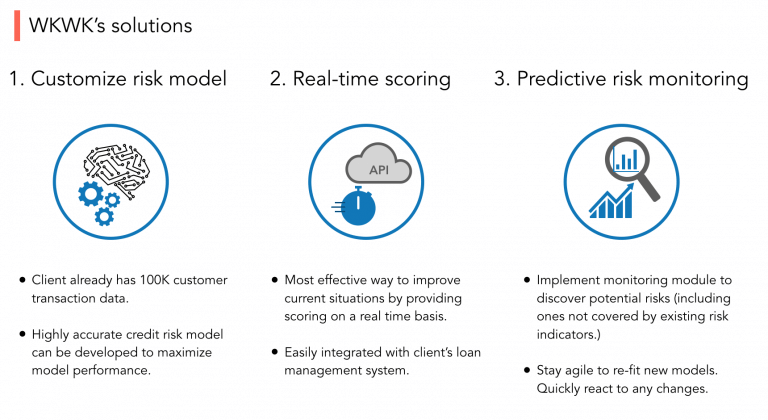

WKWK first thoroughly understood the customer needs and actual operation status and proposed “Customized” plan of HK Score to the client. Our proposals included the following points;

1) using a hundred thousand of customer transaction data as a base, the highly accurate credit scoring model can be developed, and

2) it is most effective for the clients to improve the current business situations by providing the AI credit score in real time based on the customized model.

In the beginning, the client was reluctant to share the customers data with WKWK, but later they well understood about our high security system and the model development environment and decided to implement the Customized plan.

Currently a highly accurate model is being developed based on the multiples of machine learning algorithms. The next step is to deploy the model in April.

This example demonstrates WKWK maximize the model performance by setting the feature engineering and the pattern detection efficiently. In terms of deployment of the service to the client environment, API is provided to integrate with the loan management software that the clients use in order to provide the credit score in real time. It is a service plan that enables deployment of AI credit scoring readily without affecting the existing system environment.

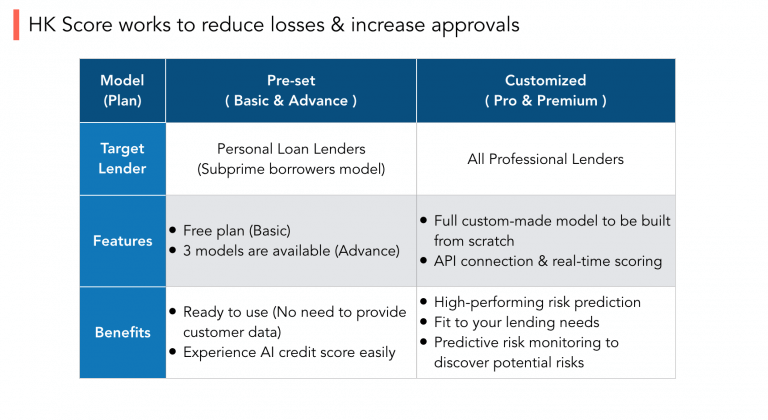

There are currently four plans in HK Score, which include Basic plan (free of charge) and Advance plan for personal loan lenders. For these plans, it is not necessary to provide the data in advance, thus it is perfect for customers who would like to understand what the HK Score is about. If you would like to experience WKWK original AI credit model and study the possibility of deploying the service to your system, please take this opportunity to try our service!

If you are considering implementing even more accurate underwriting based on machine learning, having troubles with bad debt, or attempting to improve the underwriting process to be more efficient, contact us! Our experts in lending business are committed to provide services that will improve your lending business.

WKWK aim to contribute to realize a healthy lending business with our concept of ‘transform lending with the power of machine learning’.

For details about HK Score:

https://wakuxwaku.com/hk-score/