Machine learning is transforming consumer lending

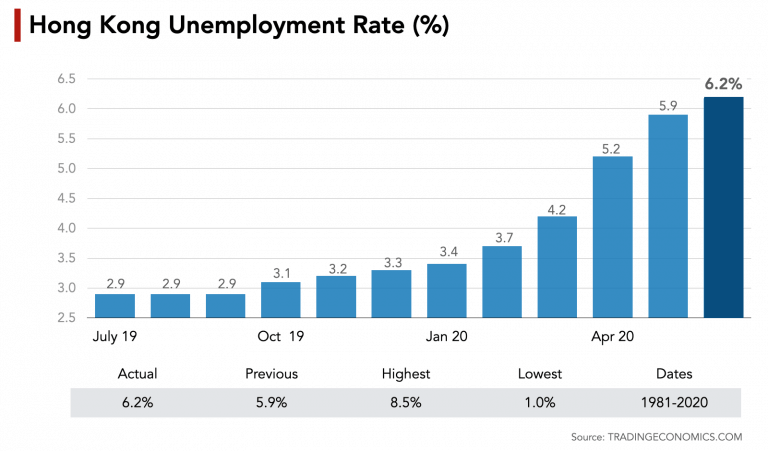

The COVID-19 remains unpredictable with potential long tail risks affecting the consumer credit market. Unemployment rates are likely to remain in high to affect consumers’ payment capabilities and has a strong correlation with delinquency rates.

Hong Kong’s unemployment rate jumps to 6.2% in June, the highest in more than 15 years.

Under the current situation with the wave of virus-driven recession, some of lenders who rely on traditional linear-regression models are just tightening underwriting for all segments of customers because they are not agile to adjust loan decisions properly and timely.

At WKWK, we’ve been building risk prediction models for lenders and believe that lenders who can get AI credit models and react quickly will be selected in the market. By searching out countless patterns in credit data, ML models can paint a more clear picture of default risk. Using ML improves lenders yields, finds good new borrowers, and broadens credit access for consumers especially in near-prime or subprime segments.

A digital transition to ML-based underwriting is underway but faces some hurdles along the path to full-scale adoption.

For an example, we often find that lenders haven’t collected digital footprints from their online channels although their new applications mainly come through the online application form. Our risk modelling team indicates some of insights that there are more data points to be observed and utilized for more accurate predictions.

- Frequency of website visits

- Detection of copy and paste text in the application form

- Inflow data on the web application (from any-where, any-time, any-device)

These data are sample variables when we build risk models and often represent consumer behaviour. More variables mean more accuracy and agility in models. However, only a few lenders have been able to fully use of the data which they already had.

We advise consumer loan lenders a structure to utilize digital footprints which can be collected inherently through their online channels along with privacy policy (including data anonymization).

While challenges persist, lenders of all sizes can see the future of the industry in AI. With high-convenience tools like our “HK Score” and the utilization of more data, lenders can make better loan decisions without raising risk regardless of the economic conditions, even in a downturn. If you are interested to learn more about AI-based risk model, contact us!