Lenders are required to consider consumer financial hardships

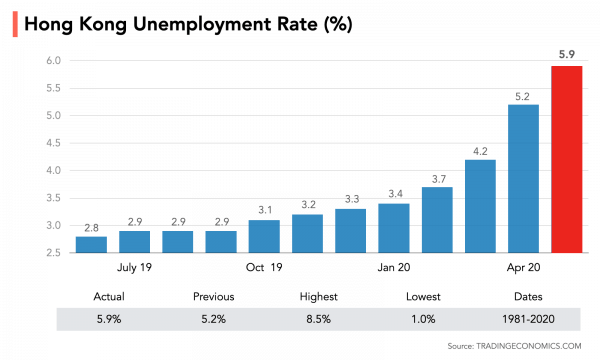

The seasonal adjusted unemployment rate in Hong Kong increased to 5.9% in the three months to May 2020 from 5.2% in the previous period, which was the highest jobless rate since the three months to April 2005, amid the virus-driven downturn.

Hong Kong unemployment hits 15-year high with 5.9% out of work

TransUnion has also released their Consumer Financial Hardship Survey by a webinar, which is now available on-demand for you to view. You can refer the following link.

Here’s the brief summary of the survey on the consumer financial hardship due to COVID-19:

- The pandemic impact on consumers in Hong Kong is quite wide and severe. Nearly 70% respondents commented that their income was affected.

- On average, the impacted consumers expected to have a shortfall of HKD 10K.

- 80% of the impacted consumers afraid that they will be unable to pay bills and loans in 3 month’s time.

As TransUnion provides a recommendation, lenders are required to extend relief programs with term extensions or grace period as well as risk analysis to identify changes in consumer behaviour over time.

At WKWK, we’ve been also discussing COVID-19’s impact on consumer finance with the subject-matter professionals. Some of their insights aligned with what we’ve seen as we’ve been using machine learning to monitor consumer credit behavior amid the pandemic.

- Get the latest information about income and employment verification

- Focus on customers with savings

- Continue to lend prudently to those who fit your risk appetite and build greater loyalty

These actions can be taken for lenders to secure a better handle on credit risk. And credit models will need to incorporate new variables that haven’t used before. Together with the right math, more valuables mean more accuracy and agility in models. Important data source for credit models post-pandemic would be:

- Checking other payment transaction data

- Leveraging trended data (including income changes and frequencies)

- Unemployment forecasts (including possibilities per industry, though these types of variables can trigger fair lending issues)

For lenders, a new world of credit modelling has already begun. If you are interested to learn more about AI model development, contact us! As we are in the difficult times, COVID-19 presents lenders with an opportunity to accelerate digital transformation and win the future of consumer lending. We believe lenders who can get AI credit models react quickly will be selected in the market.

Please refer to the link below for more details: