How prepared is your organization to discover significant emerging risks?

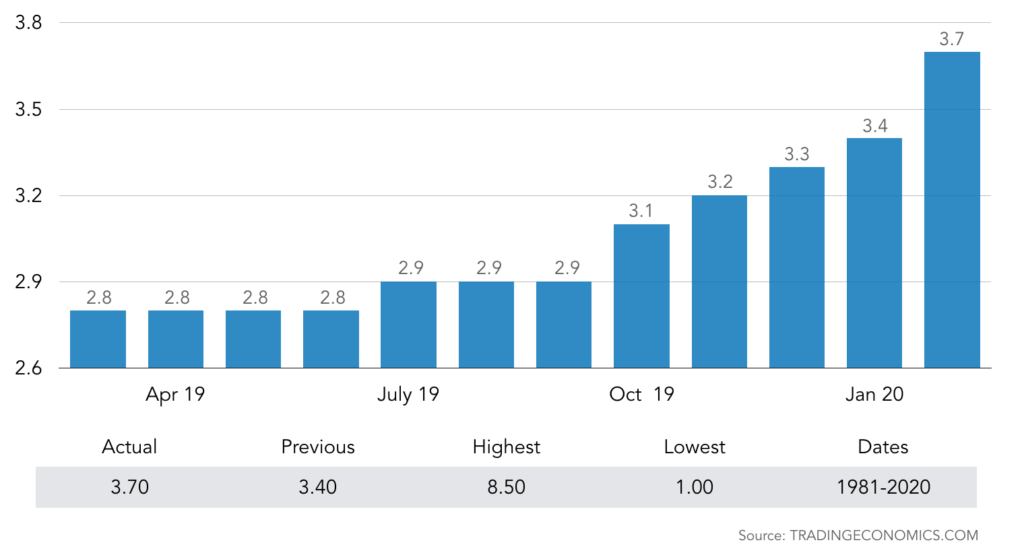

Coronavirus outbreak has been seriously impacting the economics worldwide. Hong Kong economy is clearly slumping and the uncertainty towards the future persists. Under the current significant changes in our environment, various kinds of risk factors may potentially become more evident, or new risk factors may be arisen.

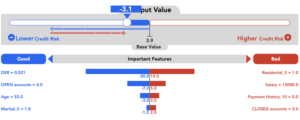

In preparation for such risk environment, CREDI AI has introduced the predictive risk monitoring for the requested customers. Predictive risk monitoring is one of our techniques to provide information such as risk analysis based on the changes in emerging risks, simulation of potential losses and risk exposures, and loan portfolio analysis for the customers who have already deployed the risk models. With this technique, the customers can regularly monitor the magnitude or changes in the potential risks which will enable to make decisions swiftly on the countermeasures.

Fundamentally speaking, in order to implement the predictive risk monitoring, it is essential to understand the importance of monitoring and deploy the tool itself.

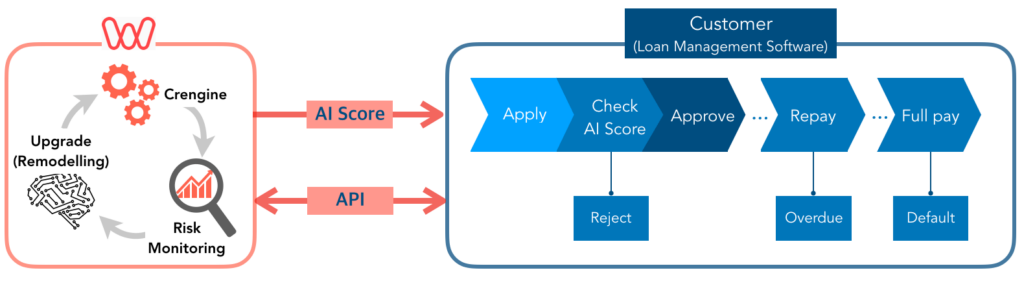

This technique monitors how well the risk prediction model that was built based on the past transaction data corresponds to the changes in environment in the future. In lending business, as you can see in the next slide, it is critical to capture the repayment performance and delinquent after approving a loan. The data can be monitored by linking the customer’s lending management software to our monitoring technique by using API, or manually updated on the regular basis. CREDI AI can take a flexible approach based on the customers’ requests.

The Hong Kong first AI credit scoring service, HK Score with Customized Plan comes with the predictive risk monitoring. After the deployment of the scoring model which can be fully customized based on the data provided by the customer, the monitoring tool can not only monitor the performance, but we also can support to swiftly correspond to the changes in environment or risk indicators. If you are seeking for a speedy way to react to the potential risks, or interested in the predictive risk monitoring, please feel free to contact CREDI AI!

WKWK aim to contribute to realize a healthy lending business with our concept of ‘transform lending with the power of machine learning’.

For details about HK Score:

https://crediai.com/hkscore/