How machine learning can help lenders from the economic crisis?

As lenders consider how to manage the emerging economic crisis from Coronavirus outbreak, many of them are looking for better data. They are going to have to re-evaluate the existing underwriting metrics to moderate potential losses and, in the future, become more selective about how they reach a good risk. Having the better tools to manage the greatest downside risk is very important not only for now but also for the future. At WKWK, we normally suggest basic practices to lenders how AI can help to limit current losses while enhancing future profitability.

1: Better Predictions

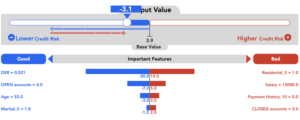

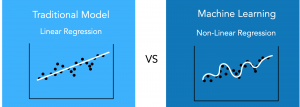

Using machine learning helps you make better use of the data you already have. In a traditional model, you might have only 30-40 data features. With machine learning, you can collect and fully make use of all available data. Instead of being confined to 30-40 variables, machine learning can expand a feature set because the models are more sophisticated which describe more clearly about borrowers’ potential risks. More data and advanced statistics modeling lead to better predictions.

Machine learning can track non-linear behavior data, such as a number of enquiries a borrower makes. Extremely low numbers of enquiries can indicate a risky borrower because the person may have a limited history and limited performance data, such as an 18-year-old who is just taking a step in building a credit history. As the number of enquiries increases, the risk typically decreases because there are more data available to describe about an applicant with more accurate prediction. For example, the number of enquiries that reaches 40-50 actually shows red flags about an applicant’s risk profile. This type of non-linear behavior can’t be captured by traditional modeling techniques.

Improvements in predictability can provide a positive impact to your performance, such as reducing defaults. The better prediction models built by machine learning can minimize non-performing loans up to 30% for new loan portfolios when an approval rate is held constant.

2: Risk Monitoring

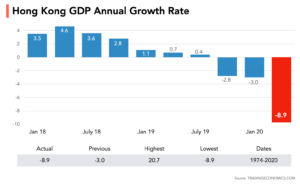

Predictions can be lost if you don’t have risk monitoring. Model monitoring ensures accuracy and validity to navigate you stay the course. We once again emphasize the importance of model monitoring with the current economic downturn from Coronavirus. Machine learning can test models as they are being trained to see whether their signals change from the training period to when they are put into the real environment. This ensures stability and reliability.

3: Quick response to re-fit new model

Machine learning can quickly alert you to change behaviors. In the time of economic uncertainty, there are bound to be changes in your borrowers which means that you may need to re-build a new model. The traditional way of re-building a new model is a heavy-lifting and at times like now, lenders have to take action speedily.

That’s where machine learning can help. It turns a year or more of work down to weeks. With more data points, there is less impact per feature. And with automated documentation, it enables lenders to quickly react to any changes.

While AI and machine learning can’t stop the volatility in the economy we are about to experience, it can help to reduce its impact on lenders portfolios.

If you are considering implementing even more accurate underwriting based on machine learning, or attempting to improve the underwriting process to be more efficient, contact us! Our experts in lending business are committed to provide solutions that will improve your lending business.

For details about HK Score:

https://crediai.com/hkscore/

Reference:

1. zest.ai