How can AI improve your lending in the time of economic uncertainty?

“Lending automation” has become one of the major themes that is discussed at every online meeting with lenders these days. The term “automation” includes many things for lending such as loan applications on a mobile device, less manual and paperless loan process, customer service through digital channels, etc. But for CREDI AI, the automation means faster and better credit decisions which are the most important agenda for all lenders, therefore it has become the most impactful solution under the current virus-driven recession.

As CREDI AI is a specialised pattern detection in your data, our predictive ML models find the hidden patterns and use more data and better math. These are custom models trained on your data so they are designed to be more predictive than pre-packaged models. In a traditional liner regression model, you might have only 30-40 data features. ML models can fully make use of all available data normally more than a few hundreds of variables, and can track non-linear behavioural data as well. The more data and better math you have, the more the borrower’s potential risks can be identified clearly.

When you have a better credit model, you can automate more approvals and improve your loan decision process with a faster response time. Automation of loan decisions enables you as a lender to improve productivity significantly with less process time and more loan approvals. You can handle more loan applications with less headcount of underwriters.

The main benefits of auto-decision are consistency and speed. We’ve heard from lenders a lot about inconsistencies of loan decisions by underwriters. This issue is a longstanding debate almost for every lender, but the problem has become a hot issue recently as the economic downturn deepens. Every underwriter has a different mentality, view and skillset which could draw an inconsistency especially at a time like now. That’s where automation can come into play.

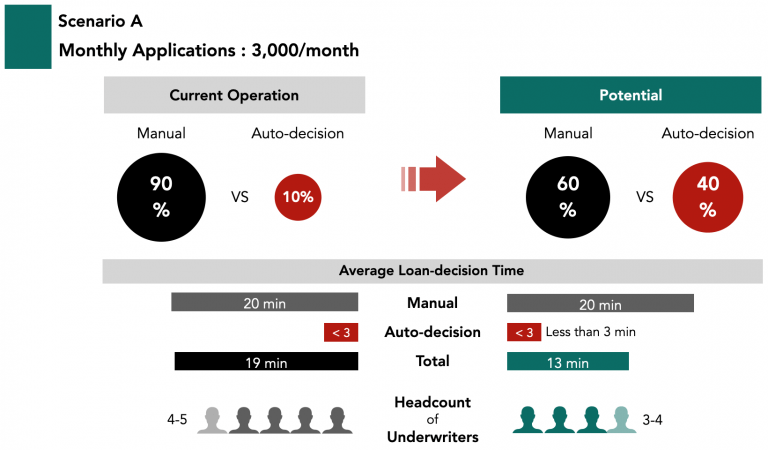

Let’s have a look at a scenario of a lender whose application volume is about 3,000 per month. Nearly 90% applications are handled manually by underwriters as he still heavily relies on manual reviews. It looks like a very conservative scenario, though it is a typical case for midsize money lenders in Hong Kong.

It is estimated that the lender would take an average of 19 minutes to respond to an application which workloads are covered by 4 to 5 underwriters. If the automation ratio can be increased to 40%, the respond time could be improved to 13 minutes and the operational overhead could be reduced nearly by 30%.

If your organization becomes more confident on auto-decision, the automation ratio can be raised accordingly. The productivity will be improved so you could have more space to handle more applications.

The largest key driving force is confidence and trust toward auto-decision in your organization. These mentalities will come with the better outcomes once you can assure to manage loan portfolio risks more effectively.

We are happy to work with you on a more detailed analysis of potential impacts that auto-decision could add value to your lending business. If you are interested in faster and better loan decisions, send us an email to: enquiry@crediai.com !