COVID-19 presents lenders with an opportunity to accelerate digital transformation!?

The whole picture of consumer credit by COVID-19 is still covered in a vail. But one thing seems to become clear for those people who are involved in consumer credit markets that the pandemic will change credit risk modeling permanently.

At CREDI AI, we’ve been discussing COVID-19’s impact on consumer finance with the subject-matter experts and professionals. Some of their insights aligned with what we’ve seen as we’ve been using machine learning to monitor consumer credit behavior amid the pandemic.

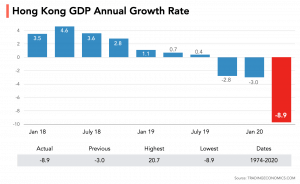

The economy of Hong Kong shrank 8.9 percent year-on-year in the first quarter of 2020. That was the steepest pace of contraction since the series began in 1974 as the COVID-19 outbreak hit the economy

Lenders need to recalibrate their risk scores under the current drastic market changes

Probably no lenders had stress-tested their credit models for a downturn of this severity, with GDP dropping almost 9% in Hong Kong. Many forecasts expect economic activities to remain dramatically weak even after the pandemic is over. Given how fast the crisis came, much of resulting consumer credit distress has yet to show up in credit bureau data and many loans are applied in grace period by lenders. Even once consumer credit distress is more accurately represented in the data, the model development and underwriting process inside most lenders are not met with the speed needed to adapt to the changes.

Agility of re-modeling is a must-have competence for lenders

Most lenders are not able to do fine-tuning their risk models in the event of economic crisis, particularly ones of this magnitude. As a result, we’ve seen many lenders stop underwriting entirely as they just wait for recovery. This situation generates a huge opportunity loss for those lenders who are unable to adjust the risk models. However, it’s going to be a big chance for other lenders who use advanced machine learning models to gain more market share by maintaining accuracy and staying agile in regardless of the market conditions.

Some actions can be taken for lenders to get a better handle on credit risk.

Here are those actions:

- Get the latest information about income and employment verification

- Focus on customers with savings

- For auto and other asset-backed lenders, adjust LTV ratios.

Credit models will need to incorporate variables they haven’t used before

Together with the right math, more variables mean more accuracy and agility in models. Important data source for credit models post-pandemic world would be:

- Checking other payment transaction data

- Unemployment forecasts (including possibilities per industry, though these types of variables can trigger fair lending issues)

- Variables related to potential high-impact low-probability events like natural disasters

Lenders who can get AI credit models react quickly will be selected in the market

Lenders use their credit models that use only 20-30 variables, rely on elementary math and need a time of a year for re-building models are outdated. The only way for lenders to thrive in this credit market is to use more data, machine learning models and tools that have models react to changes quickly. At CREDI AI, our AI tools are able to monitor input and output distributions, outliers and new variables as well as underwriting performance like approval/rejection rate in real-time.

Many of us may be heading back to offices soon, but the impacts of COVID-19 in consumer credit market will be continued. For lenders, a new world of credit modeling has already begun. If you are interested to learn more about AI model development, contact us! As we are in the difficult times, COVID-19 presents lenders with an opportunity to accelerate digital transformation and win the future of consumer lending.

For details about HK Score:

https://crediai.com/hkscore/

Reference:

1. zest.ai