COVID-19 presents fintechs with an opportunity to accelerate collaborations between banks!?

Agility and resiliency are keys to reflect the new normal after COVID-19. Organizations are required to adjust their data and methodologies speedily, and banking is no exception. The below link is a highly suggestive insight from McKinsey & Company.

Model risk management (MRM) is the big issue for all banks as their models have broken down across their business. How can they best address this challenge?

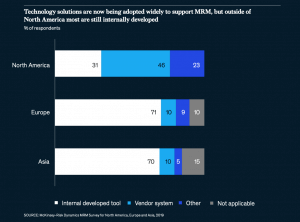

Technology and talent are obviously key enablers for MRM. North America is clearly leading the pace in technology adaption and investment, however other regions are facing a large space for a catch-up because they still too much rely on inhouse development according to the data shown below.

The speed of reaction to the crisis is definitely crucial. COVID-19 presents fintechs like us with an opportunity to accelerate collaborations between banks!? It could be a turning point and we hope to see many collaborations will come true for building better risk models together.

Please refer to the link below for more details:

https://www.mckinsey.com/business-functions/risk/our-insights/banking-models-after-covid-19-taking-model-risk-management-to-the-next-level

Banking models after COVID-19: Taking model-risk management to the next level

The COVID-19 pandemic is taking a terrible toll in human life and in the livelihoods of millions the world over. As people and institutions struggle to contain the spread of the virus, the measures necessarily imposed have caused major economic disruptions. Every industry has been affected, and banking is no exception.