Insights

What comes next to consumer credit market in Q2 2020?

Delinquency rates have been increased and lenders have tightened underwriting in Q1 2020. What comes next to consumer credit market in Q2? TransUnion has released their Q1 2020 Industry Insights Report by a webinar, which is now available on-demand for you to view anytime. You can refer the following link. Here’s the brief summary of the report on the consumer credit market: As TransUnion gives a heads up, money lenders who concentrate their loan portfolio within near prime or below segments should carefully monitor the downward risk amid the economic downturn. At CREDI AI, we can build a high-performing predictive model for lenders who even focus on risky segment such […]

COVID-19 presents fintechs with an opportunity to accelerate collaborations between banks!?

Agility and resiliency are keys to reflect the new normal after COVID-19. Organizations are required to adjust their data and methodologies speedily, and banking is no exception. The below link is a highly suggestive insight from McKinsey & Company. Model risk management (MRM) is the big issue for all banks as their models have broken down across their business. How can they best address this challenge? Technology and talent are obviously key enablers for MRM. North America is clearly leading the pace in technology adaption and investment, however other regions are facing a large space for a catch-up because they still too much rely on inhouse development according to the […]

COVID-19 presents lenders with an opportunity to accelerate digital transformation!?

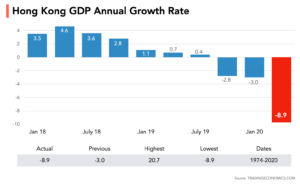

The whole picture of consumer credit by COVID-19 is still covered in a vail. But one thing seems to become clear for those people who are involved in consumer credit markets that the pandemic will change credit risk modeling permanently. At CREDI AI, we’ve been discussing COVID-19’s impact on consumer finance with the subject-matter experts and professionals. Some of their insights aligned with what we’ve seen as we’ve been using machine learning to monitor consumer credit behavior amid the pandemic. The economy of Hong Kong shrank 8.9 percent year-on-year in the first quarter of 2020. That was the steepest pace of contraction since the series began in 1974 as the […]

How machine learning can help lenders from the economic crisis?

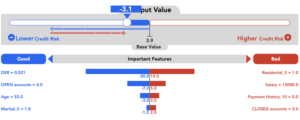

As lenders consider how to manage the emerging economic crisis from Coronavirus outbreak, many of them are looking for better data. They are going to have to re-evaluate the existing underwriting metrics to moderate potential losses and, in the future, become more selective about how they reach a good risk. Having the better tools to manage the greatest downside risk is very important not only for now but also for the future. At WKWK, we normally suggest basic practices to lenders how AI can help to limit current losses while enhancing future profitability. 1: Better Predictions Using machine learning helps you make better use of the data you already have. […]

Why explainable AI is more important than ever?

There is no doubt that in the next six months to a year, the entire economy is going to look radically different — especially for the financial industry. Lenders, in particular, are going to have to re-evaluate the metrics they use for underwriting loans and, as they make those changes, transparent is going to be essential. Consumers, stakeholders and regulators are going to demand it. Why was one person approved a loan while another was rejected? In an economy increasing unemployment, how are lenders judging who is a good risk? What measures are lenders taking to limit their exposure to non-performing loans? An explainable AI refers to how easy it is for humans to understand the processes it uses to arrive at its outcomes. Until recently AI algorithms have been notorious for being “black […]

How prepared is your organization to discover significant emerging risks?

Coronavirus outbreak has been seriously impacting the economics worldwide. Hong Kong economy is clearly slumping and the uncertainty towards the future persists. Under the current significant changes in our environment, various kinds of risk factors may potentially become more evident, or new risk factors may be arisen. In preparation for such risk environment, CREDI AI has introduced the predictive risk monitoring for the requested customers. Predictive risk monitoring is one of our techniques to provide information such as risk analysis based on the changes in emerging risks, simulation of potential losses and risk exposures, and loan portfolio analysis for the customers who have already deployed the risk models. With this […]

The reasons why evaluation of confusion matrix such as Accuracy cannot be used in binary classification

The characteristic such as Accuracy are often used to evaluate the accuracy of the machine learning, but this is not the case in the financial sector. Before explaining the reasons why it is not used in the financial sector, let me explain about the evaluation index including confusion matrix. For those who are familiar with the terms, please skip to “Problems” and “Conclusion”. Confusion matrix Confusion matrix is a summary of the prediction and its results in a matrix format. In the case of binary classification in the machine learning, the predicted probability and its predicted clarification will be the output. For example, the ratio of becoming delinquent and not […]

Predictive model evaluation -Gini Coefficient-

introduction It is said that the model which is made by AI often becomes black boxes, but nowadays they are changing to a more descriptive form. WKWK also has a white box model that users can understand.So how a risk model should be evaluated by when machine learning? In the case of credit scores, one of the representative indicators is the Gini Coefficient. In general consumer finance, the value varies greatly depending on the business model, such as 30% to 80%. It becomes one of the substantial reasons to say it is a credible model when the values are higher.Let us explain what the Gini coefficient is. What is Gini […]