Agility is becoming more crucial for lenders than ever

Hong Kong’s jobless rate from August to October period stood at 6.4%, a 16-year high, according to the latest labor force statistics. Recently, we’ve seen that travel sector was hit hard, Cathay Pacific and travel agencies have been cutting jobs. The government’s Employment Support Scheme appears stalled and will be ending soon, the economy will be prepared for a wave of layoffs from SMEs and some of major corporations.

COVID has induced economic uncertainty to stay longer, and companies will need to tap into greater agility to get over difficulties from market volatility. Banks and money lenders are required to help borrowers through a variety of relief services, such as payment deferrals, fee waivers and longer grace period while facing more delinquencies and navigating relief programs.

In lending, agility is becoming more crucial to secure the sustainability of business at the moment. Innovative lenders are agile to adjust loan decisions correctly and speedily in the risky environment, however some of them are just enhancing to tighten credit decisions while shifting more defensive and deteriorating future profitability.

Framework for Agile Lending

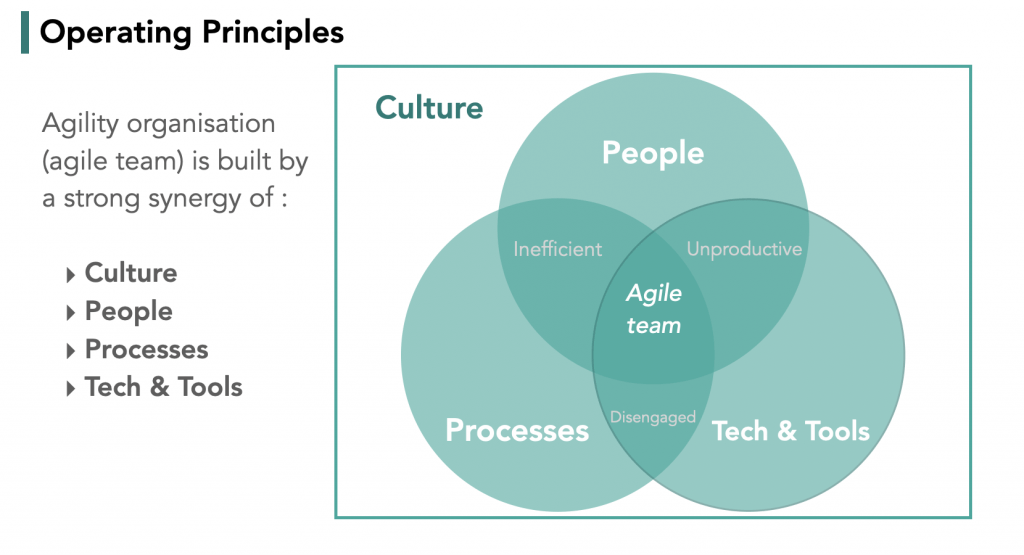

At CREDI AI, our main service is to provide tech & tools for better and faster lending decisions though, we navigate operating principles for lenders to address agility and make priorities for their approach. Tech & tools are key elements and indispensable for the agility, however agile lending is built by a strong synergy of culture, people, processes, and tech & tools. You need to have the right people, processes and right tech & tools on top of your corporate culture.

Why Do You Need “Agile”?

Agile transformation from your existing operation is not converted in a moment. There is a process and measures to adopt agility in your lending environment that we’re currently refining. Most importantly, the understanding of the reasons why you need “Agile” is the key driving force for the transformation.

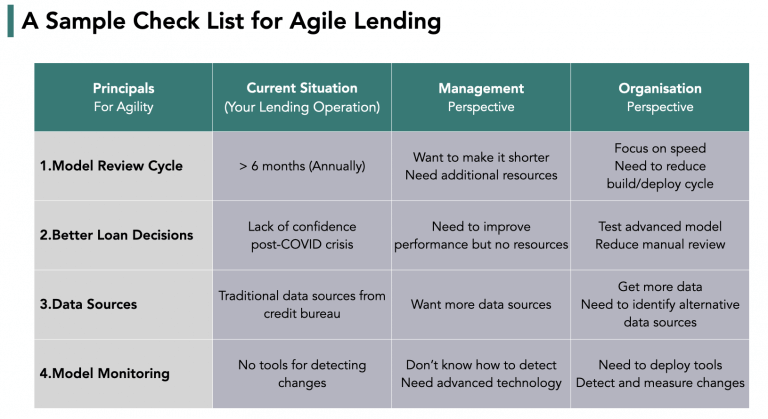

The below chart shows a sample check list for agile lending. Definitely, the risk model is the most important element for agility, and it would be the bottleneck for sustainability to reflect entire the lending operation efficiency and profitability.

These will be guidelines for lending agility. Agile lenders will be required to have the following capabilities:

1. Model Review Cycle:

To shorten review cycles is a good first step for many lenders. As COVID has induced traditional credit models to deteriorate the reliability, the urgency of updating the models is required. A review cycle time from model build to deploy is needed to reduce in order to adjust more quickly to market volatility.

2.Better Loan Decisions:

Confidence in model performance is critical for lenders. If your model was trained by pre-COVID data, the accuracy won’t improve. Your credit model has to be updated and needs to increase its performance based on data in a post-COVID environment. Leverage machine learning to identify potential risk more clearly and make better decisions with confidence.

3.Data Sources:

Using traditional data from credit bureau would be the primary source of your existing credit model as same as most of lenders. Lenders need to diversify data sources and try to go beyond just using traditional data. Alternative sources like transaction patterns of bank accounts, education, MPF balances and employment history should be reviewed. Also, using model building company like us can detect additional patterns from your lending data, which help you to build higher predictive models within your data sources.

4.Model Monitoring:

Risk monitoring on credit model is a must-have function for agile lenders. It has been a challenge to detect behavioural changes, but you can deploy a tool like our software “HK Score” which can help you find risk indicators and limit impact from market volatility.

As we are committed to improve lending business, not just promoting and selling our tech & tools, so that we navigate whole processes for the agile lending and take necessary initiatives to ensure changes for better lending. Lenders are facing a real opportunity to become more agile so that they can help borrowers during the economic crisis. Agile lending requires for your credit model agility and enables long-term sustainability of your lending business.

Reference: zest.ai