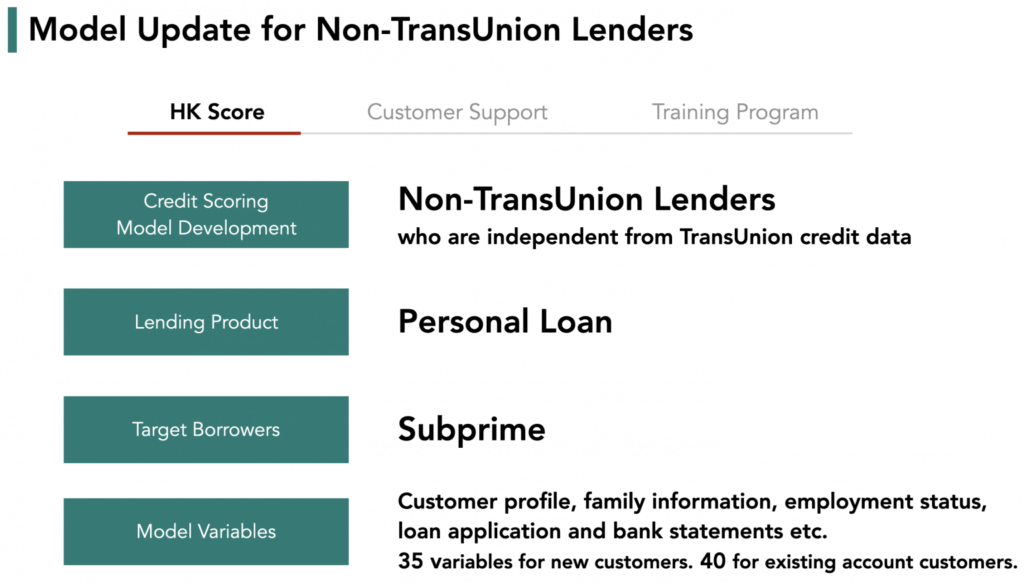

A credit scoring model for non-TransUnion lenders has been just updated and now available with HK Score

We are pleased to announce the update of credit scoring model for non-TransUnion members. The non-TransUnion members are money lenders who are independent from TransUnion’s credit history data. In general, they are targeting subprime borrowers and dealing with higher credit risks in the consumer credit market without accessing TransUnion’s data.

However, most of them don’t have risk modelling and credit scoring so that they still rely on human decisions with inconsistency which tend to include unnecessarily biases and they cannot correctly respond to environment changes at time like now. This is where CREDI AI can improve.

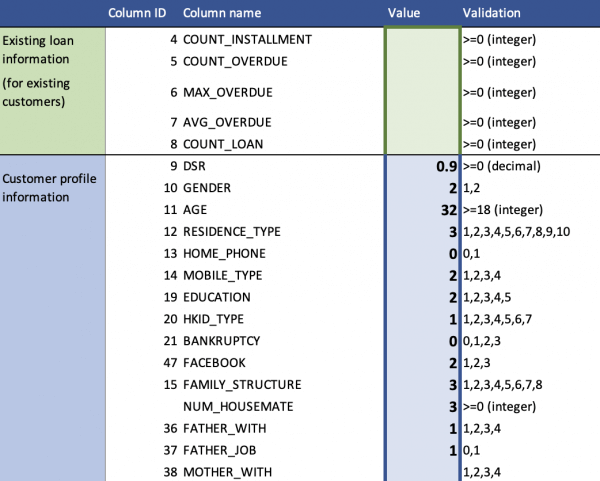

The model can help those lenders to start measuring potential risks by using credit scores. Credit underwriters will be able to use the model in combination with their manual review at need. As the model predicts default risks with using variables and information from applicants including their latest employment status and bank statements, those model components would be aligned underwriters with their expertise and experiences so that they can use the model without incompatibility. The below shows sample variables for lenders to input. The model has about a total of 40 variables for existing customers and 35 for new customers respectively in order to calculate probability of defaults.

Sample variables

Plus, our explainable model has a transparency to understand outcomes. Underwriters can easily identify most impactful variables to the credit score and understand how variables affect each other. Providing the ability to understand the model’s reasoning and important features allow lenders to make credit decisions with confidence.

Just to be sure, the model is not a perfect fit for each of those lenders for now. The model has an enough accuracy for a practical use to predict default risks of applicants, however the model is an initial structure that will allow lenders to leverage machine learning as soon as lenders collect enough data. Also, it is always inevitable for lenders to do KYC completely, otherwise the model won’t be able to show its full ability. Model accuracy will be improved and updated once more lenders start using this initial version and more data to be collected.

In the difficult times with COVID-19 pandemic, the situations have created an opportunity for the lenders to accelerate digital transformation and win the future of lending. A new world of credit modelling has already begun. If you are interested to learn more about this model, contact us!

- Non-TransUnion lenders:

As above-mentioned, they are money lenders who are independent from TransUnion’s credit data. They make credit decisions without accessing TransUnion. More than 300 non-TransUnion lenders are actively doing the business in the consumer credit market in Hong Kong. Most of them rely on underwriter’s manual review for credit decisions which tend to include unnecessarily biases based on experiences. CREDI AI help them transform AI-driven credit decisions with consistency and transparency.

- Credit scoring models with auto-decisions:

At CREDI AI, we also provide credit scoring models for TransUnion members. We are currently working with several lenders who are TransUnion members. We provide custom models trained on your data so they are designed to be more predictive than pre-packaged models. When you have a better credit model, you can automate more approvals and improve loan decision process with a faster response time.