How can Automation come into play in your lending?

As we have talked about the mechanism in my previous post, the utilization of AI will enable you to make faster and better credit decisions which are the thrust for thriving lending business. (Please check my previous post for more details.)

Now we’d like to talk about the way to proceed with it. We understand that every lender has a different view for automation and needs for a comfortable way of reaching targets in their process. In this post, we’d like to talk about the insights on how auto-decision can come into play in your lending operation.

Again, the largest obstacle on the auto-decision would be mentalities. Your loan decisions will become more AI-driven once your organization gains more confidence and trust toward the machine learning models. And the outcomes will demonstrate that the predictive results are rational. In prior to that, your lending needs to have a better credit model before auto-decision. After that, the approvals and rejections can be automated, and then the loan decision process can be improved with speed and quality.

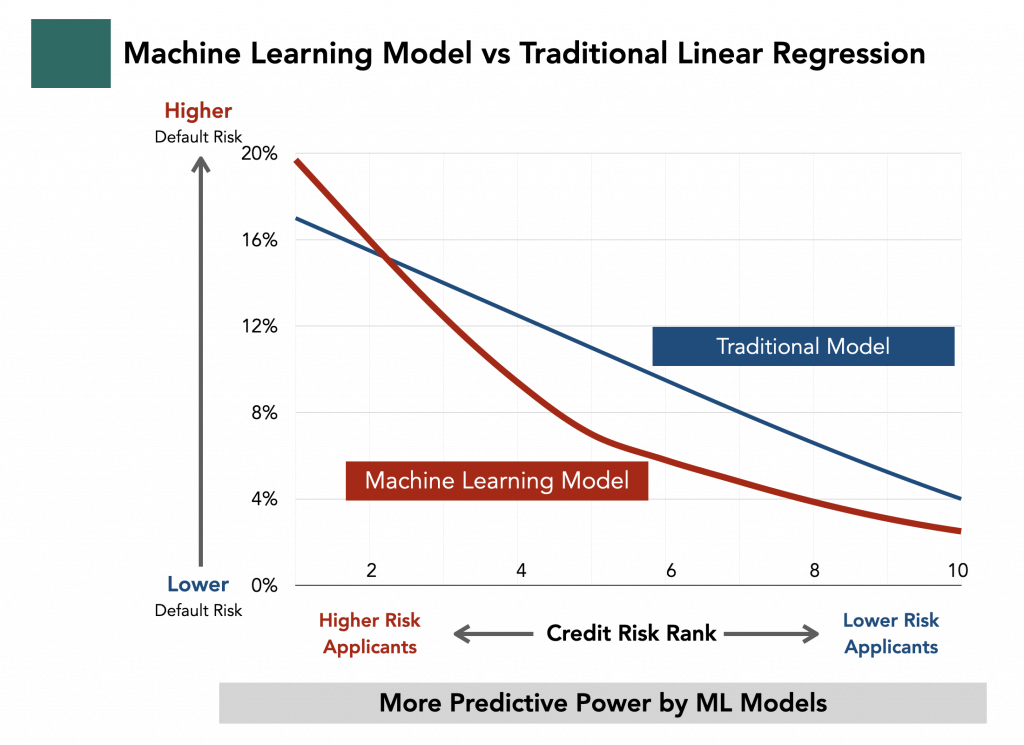

Here is a comparison chart in terms of predicted risk of applicants who mostly belong to sub-prime segment. The vertical axis shows a percentage of probability of defaults (PD). In the horizontal axis, a number represents an applicant credit rank. The lower the rank is (goes to the left), the higher the risk is.

The blue line is a traditional linear-regression model. The red one represents a machine learning model. Obviously, the ML model has more predictive power than that of traditional one. While a traditional model is nearly a perfect diagonal line, the ML draws a much steeper curve at the higher-risk end and the risks are reduced from the middle ranks. While only 30-40 variables are available for the traditional models, but ML can make a full use of a few hundreds of variables or more. That’s why ML can paint more clearly about borrower’s risk by using more data and better math.

CREDI AI builds high predictive models which customise your lending performance data. In your data, more patterns will be detected by our risk modelling team and added them to the data sets. The more the data and the better math we use, the more accurate and the higher predictive models can be built. Now with the smarter predictions like our customise model, your lending can start to run auto-decision in your operation.

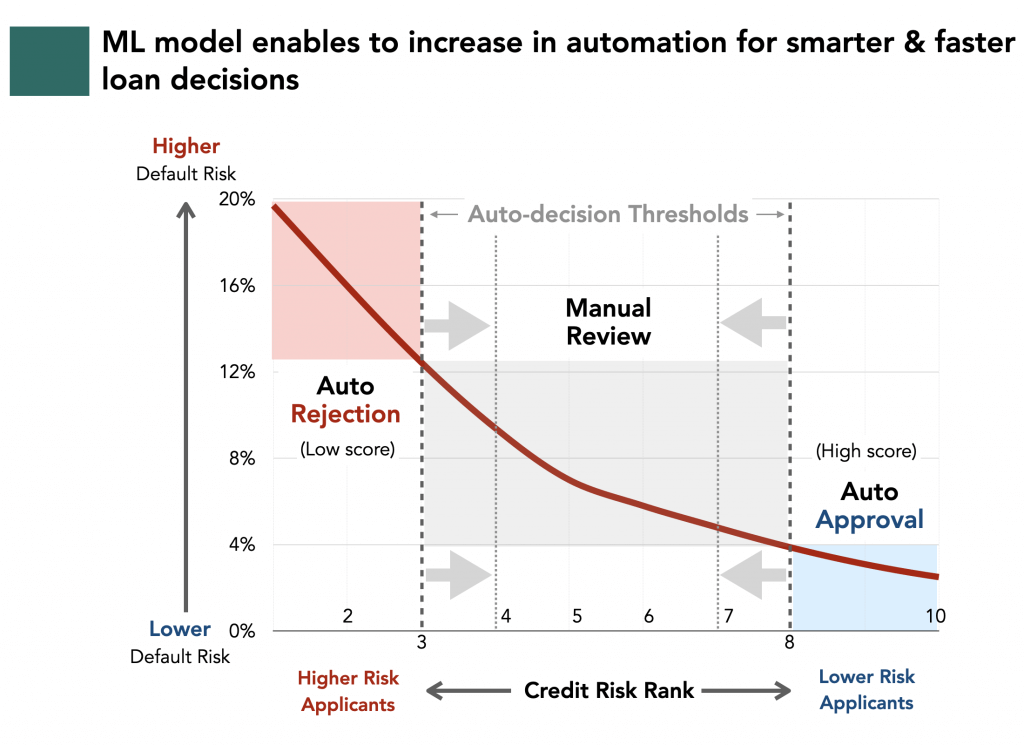

This chart represents an auto-decision guideline which we use for navigating automation for our lender partners. Once you’ve got these risk indicators, you can set up and identify appropriate cut-off lines that you are going to auto-approve or auto-reject. Applicants in the middle are required for the manual review.

For example, one of our customers was in 10% of auto-decision operation when we started a partnership about a year ago, which applied auto-rejection only for higher risk applicants, and the rest of 90% was manually reviewed. Now, 40% of the auto-decision has come into play. The risk model has grown their confidence and started to apply the auto-approval for some lower risk applicants.

More than 40% of auto-decision could be applied for this customer as the predictive results were proven. However, we understand that they still need a little more time to boost the auto-decision in the time of economic uncertainty. It would take some time for lenders to have a comfortable approach with the automation. Confidence and trust are earned over time as the predictive results demonstrate itself.

Once your organization gains more confidence on the risk model, you can adjust cut-off lines and increase in auto-approval and/or auto-rejection rates. For example, in the above chart, auto-approval rates can be increased by changing the cut-off line from the credit rank 8 to 7. For more auto-rejection, the threshold can be widened from 2 to 3. Consequently, the manual review will be lessened so that the faster response time will be generated accordingly.

We will talk about system integration in the next post. How ML model and auto-decision can be integrated into your existing loan management system is one of most popular FAQs from lenders.

We are happy to discuss about how the auto-decision can grow your lending in the time of virus-driven recession. If you are interested in faster and better loan decisions, send us an email to: enquiry@crediai.com !