How can Auto-decision adapt to your existing lending system?

Now we’d like to talk about system integration in this post. How ML model and auto-decision can be integrated into your existing loan management system is one of most popular FAQs from lenders. (As we talked about the way to proceed with auto-decision in my previous post.)

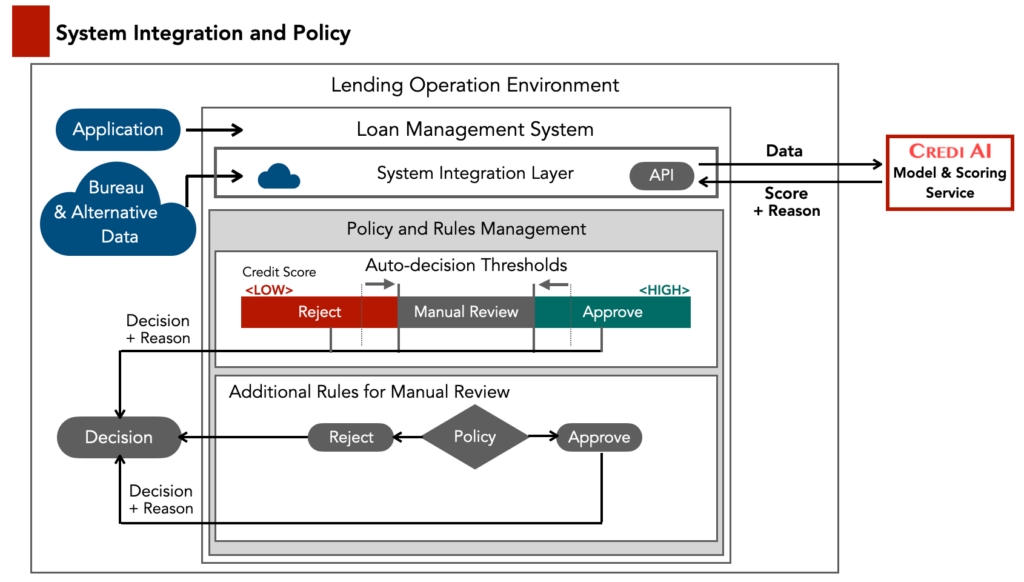

Here is the image of system integration and underwriting policy in your existing loan operation environment. First, an application of loan is submitted to the loan management system. Then bureau data is acquired for that particular applicant by lender. The application and bureau data are provided via an API to your model which is running in a crowd server managed by CREDI AI.

Just to be sure, the application data does not include any kinds of sensitive data such as full name, ID number and phone number etc. Plus, data anonymization is applied when required so you don’t have to worry about your privacy policy and data protection. For API connectivity, we will build integrations and work with your IT team and/or system provider so it will be solved easily.

The model will then return the AI score and the reasons into the decisioning component of your loan management system on a real-time basis. AI scores that meet auto-decision thresholds will result in either ‘approved’ or ‘rejected’. If the score goes into the middle range, manual reviews are required for underwriters to check more details and/or request the applicant to provide additional information if necessary.

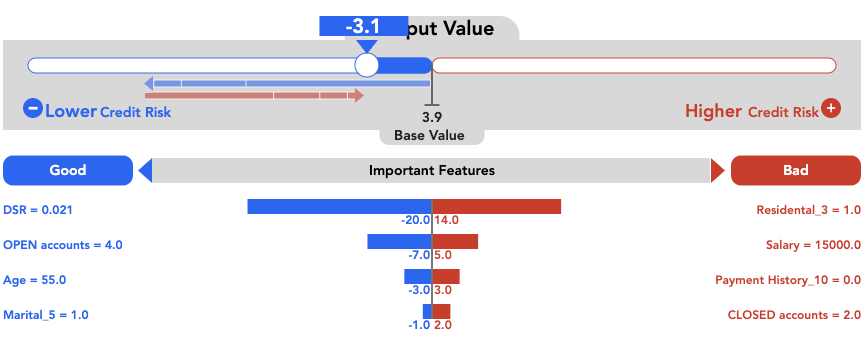

At CREDI AI, the model tells your underwriters about the reasons behind the AI score as the below image. The risk models apply Shapley values to explain features that affect credit risks so that underwriters can easily identify what important features are and understand the impact levels of each variable on the risks. Also, positive (in blue colours) and negative (red) variables that affect the score are easily found so that manual reviews should be done efficiently by checking and adding more information based on these variables if needed.

Once your organization gains more confidence on the risk model, you can adjust cut-off lines and increase in auto-approval and/or auto-rejection rates. Consequently, the manual review will be lessened so that the faster response time will be generated accordingly.

Ensuring safe and efficient operation based on the machine learning model is an inevitable path for lenders in order to gain more confidence and trust on the model, especially in the time of economic uncertainty. CREDI AI deploys monitoring features for lenders to keep monitoring on model accuracy so that lenders receive alerts if the software detects any outliers which can affect risk predictions.

We will talk about the importance of monitoring next time. In fact, we’ve seen deterioration in credit qualities for some segments in Hong Kong’s consumer credit market. As monitoring has become more important in the time like now, agility and resilience of re-building the model are required for lenders if your risk model was trained only by the pre-pandemic data.

We are happy to discuss about how the auto-decision can grow your lending in the time of virus-driven recession. If you are interested in faster and better loan decisions, send us an email to: enquiry@crediai.com !