Why explainable AI is more important than ever?

There is no doubt that in the next six months to a year, the entire economy is going to look radically different — especially for the financial industry. Lenders, in particular, are going to have to re-evaluate the metrics they use for underwriting loans and, as they make those changes, transparent is going to be essential.

Consumers, stakeholders and regulators are going to demand it. Why was one person approved a loan while another was rejected? In an economy increasing unemployment, how are lenders judging who is a good risk? What measures are lenders taking to limit their exposure to non-performing loans?

An explainable AI refers to how easy it is for humans to understand the processes it uses to arrive at its outcomes. Until recently AI algorithms have been notorious for being “black boxes”, providing no way to understand their inner processes and making it difficult to explain insights to stakeholders.

When using an algorithm’s outcomes to make high-stakes decisions, it’s important to which features the model did and did not take into account. In regulated industries like banking, it is very important to be able to understand the factors that contribute to likely outcomes in order to comply with regulation and industry practices. It’s impossible to use AI in credit underwriting in a way that is responsible both to business goals and requirements without transparency.

At CREDI AI, we have provided several components that result in highly human-explainable credit risk models:

- Model development gives insight into the processing steps that each model uses to arrive its credit scores which helps you to understand the models build by CREDI AI and explain them to stakeholders if needed.

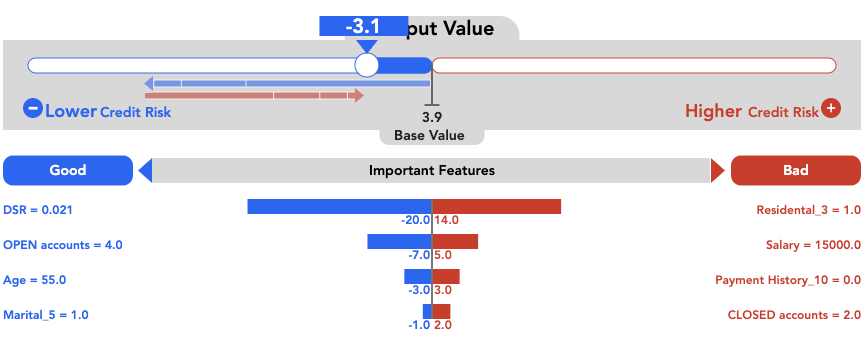

- Prediction explanations show the top variables that impact the credit score for each record, allowing you to explain why your model came to its conclusions.

- The feature effects chart exposes which features are most impactful to the model and how changes in the values of each feature affect the credit score.

Here is the sample animation of our human-explainable credit score. Credit underwriters can easily identify what are important features and understand the impact levels of each feature on the credit risks. Providing the ability to understand a model’s reasoning and important features allows lenders to make credit decisions with confidence.

If you are considering implementing even more accurate underwriting based on machine learning, attempting to improve the underwriting process to be more efficient, contact us! Our experts in lending business are committed to provide services that will improve your lending business.

For details about HK Score:

https://crediai.com/hkscore/

References:

1. zest.ai

2. datarobot.com