April 2020

How machine learning can help lenders from the economic crisis?

As lenders consider how to manage the emerging economic crisis from Coronavirus outbreak, many of them are looking for better data. They are going to have to re-evaluate the existing underwriting metrics to moderate potential losses and, in the future, become more selective about how they reach a good risk. Having the better tools to manage the greatest downside risk is very important not only for now but also for the future. At WKWK, we normally suggest basic practices to lenders how AI can help to limit current losses while enhancing future profitability. 1: Better Predictions Using machine learning helps you make better use of the data you already have. […]

Why explainable AI is more important than ever?

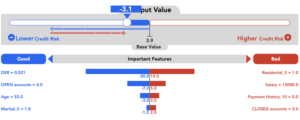

There is no doubt that in the next six months to a year, the entire economy is going to look radically different — especially for the financial industry. Lenders, in particular, are going to have to re-evaluate the metrics they use for underwriting loans and, as they make those changes, transparent is going to be essential. Consumers, stakeholders and regulators are going to demand it. Why was one person approved a loan while another was rejected? In an economy increasing unemployment, how are lenders judging who is a good risk? What measures are lenders taking to limit their exposure to non-performing loans? An explainable AI refers to how easy it is for humans to understand the processes it uses to arrive at its outcomes. Until recently AI algorithms have been notorious for being “black […]