March 2020

How prepared is your organization to discover significant emerging risks?

Coronavirus outbreak has been seriously impacting the economics worldwide. Hong Kong economy is clearly slumping and the uncertainty towards the future persists. Under the current significant changes in our environment, various kinds of risk factors may potentially become more evident, or new risk factors may be arisen. In preparation for such risk environment, CREDI AI has introduced the predictive risk monitoring for the requested customers. Predictive risk monitoring is one of our techniques to provide information such as risk analysis based on the changes in emerging risks, simulation of potential losses and risk exposures, and loan portfolio analysis for the customers who have already deployed the risk models. With this […]

The reasons why evaluation of confusion matrix such as Accuracy cannot be used in binary classification

The characteristic such as Accuracy are often used to evaluate the accuracy of the machine learning, but this is not the case in the financial sector. Before explaining the reasons why it is not used in the financial sector, let me explain about the evaluation index including confusion matrix. For those who are familiar with the terms, please skip to “Problems” and “Conclusion”. Confusion matrix Confusion matrix is a summary of the prediction and its results in a matrix format. In the case of binary classification in the machine learning, the predicted probability and its predicted clarification will be the output. For example, the ratio of becoming delinquent and not […]

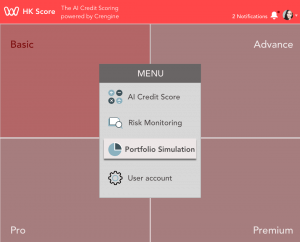

Use case of HK Score ‘Customized’ plan

The Hong Kong first AI credit scoring service, “HK Score”, has been launched by WKWK recently and we already have a contracted client that is about to start deploying the service. Let us share some details about the service that we are currently providing using the case of this client as an example this time. The client has several years of experiences as a leader of personal loan business and they have a cumulative total of approximately a hundred thousand of customers. They have simple score cards as an internal underwriting process. However, it has not been updated since the implementation several years ago and now it is being used […]