February 2020

Unleash Gen Z’s credit potentials

Most of lenders still believe in a myth that Gen Z consumers are in the subprime or generally higher risk credit tiers due to a lack of positive repayment histories, but is this really true? According to TransUnion’s report, Gen Z consumers are more likely to be prime or prime plus, and nearly a quarter (24%) have credit scores in the super prime risk segment in Hong Kong market. Why not you as lenders to promote your loan products to Gen Z? WKWK will set up a structure that allows you to leverage machine learning as soon as you collect enough data to create your own risk models. Unleash Gen Z’s credit potentials […]

Website just updated!

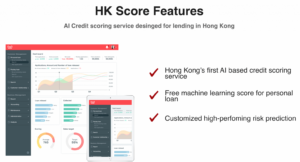

Website has been updated in conjunction with the launch of our new service “HK Score”. A new page for HK Score has been added together with the language in traditional Chinese as well. HK Score is the Hong Kong first AI credit scoring service developed for lending business in Hong Kong. With WKWK original machine learning technologies, risk prediction model is even more simple, the underwriting and credit decisions becomes more precise and speedy. We can transform lending with the power of machine learning.In order for us to contribute to a healthy growth of lending business in Hong Kong, the plans and the price setting have been reviewed so that […]

HK Score debut!

“HK Score”, the Hong Kong first AI credit scoring service, has debut. HK Score which utilizes WKWK original machine learning technologies will be provided as a subscription service for those in lending business in Hong Kong.WKWK aims to contribute to a healthy growth in Hong Kong lending business through HK Score. Based on the AI credit score provided by HK Score, the visualization of risk prediction and quantitative analysis become possible. This will lead to minimization of bad loan and maximization of portfolio return. In addition, as the credit decisions will be made based on the machine learning technologies, unnecessary biases will be excluded from its decisions, which will result […]